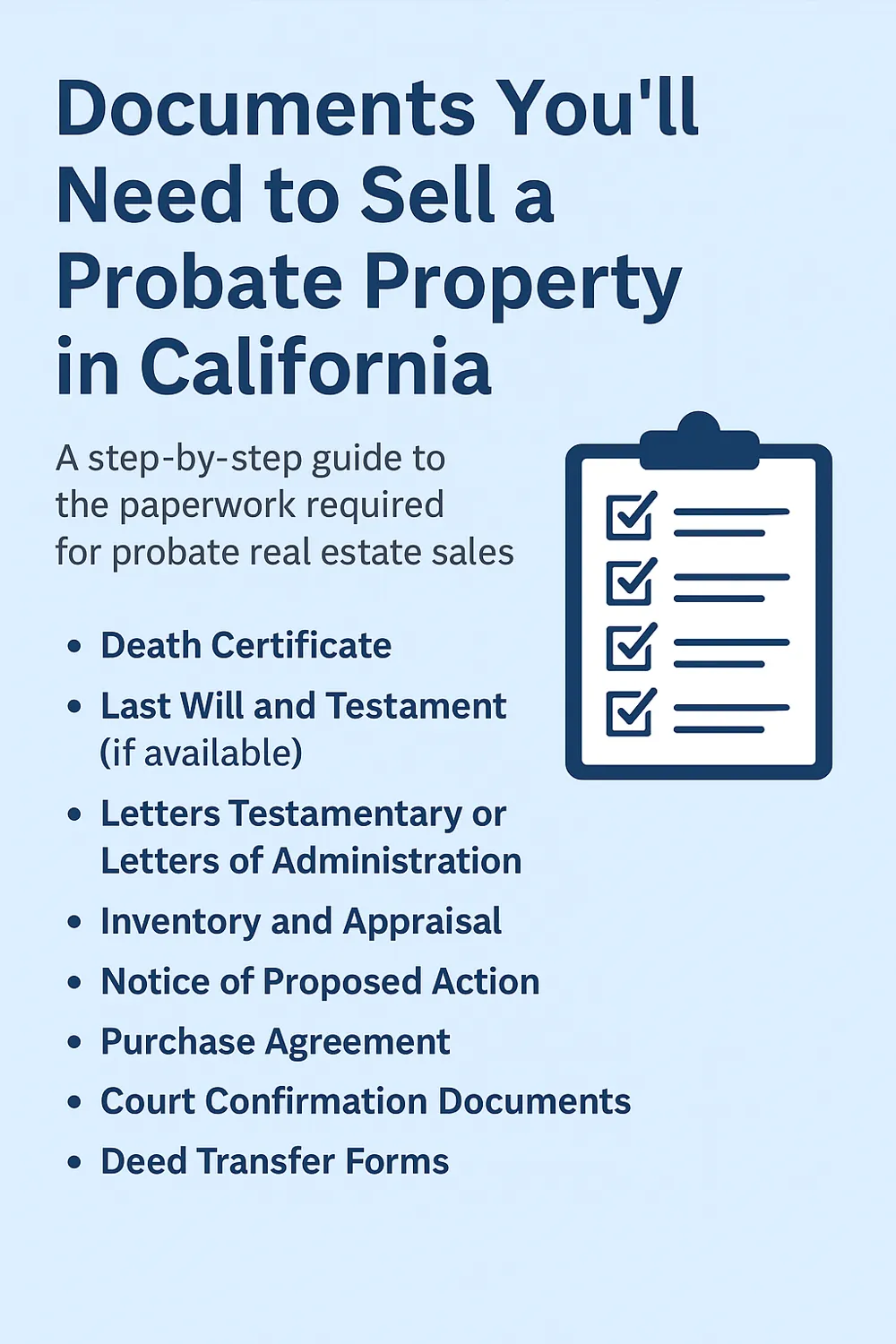

Checklist: Documents You’ll Need to Sell a Probate Property in California

A step-by-step guide to the paperwork required for probate real estate sales.

Why Documentation Matters in Probate Sales

Selling a property through probate involves more than a standard real estate transaction. California probate law requires specific documents to ensure the sale is legally valid and court-approved. Being prepared with the right paperwork can save time, avoid delays, and reduce stress.

Essential Documents Checklist

- Death Certificate – Official proof of the decedent’s passing is required to begin probate.

- Last Will and Testament (if available) – Determines the executor and distribution of assets.

- Letters Testamentary or Letters of Administration – Court-issued documents giving the executor or administrator authority to act.

- Inventory and Appraisal – A court-approved valuation of the estate, including real property.

- Notice of Proposed Action – Required in many probate sales to notify interested parties of the intent to sell.

- Purchase Agreement – Standard contract between buyer and seller, often subject to court confirmation.

- Court Confirmation Documents – In some cases, the sale must be confirmed in court before closing.

- Deed Transfer Forms – Legal documents transferring ownership of the property to the buyer.

Additional Helpful Records

- Mortgage statements and payoff information

- Property tax bills

- Insurance policies

- HOA documents (if applicable)

Key Takeaways

- Probate real estate sales require more documentation than traditional sales.

- The executor or administrator must gather and file official court documents.

- Being organized with paperwork helps streamline the sale and avoid legal issues.